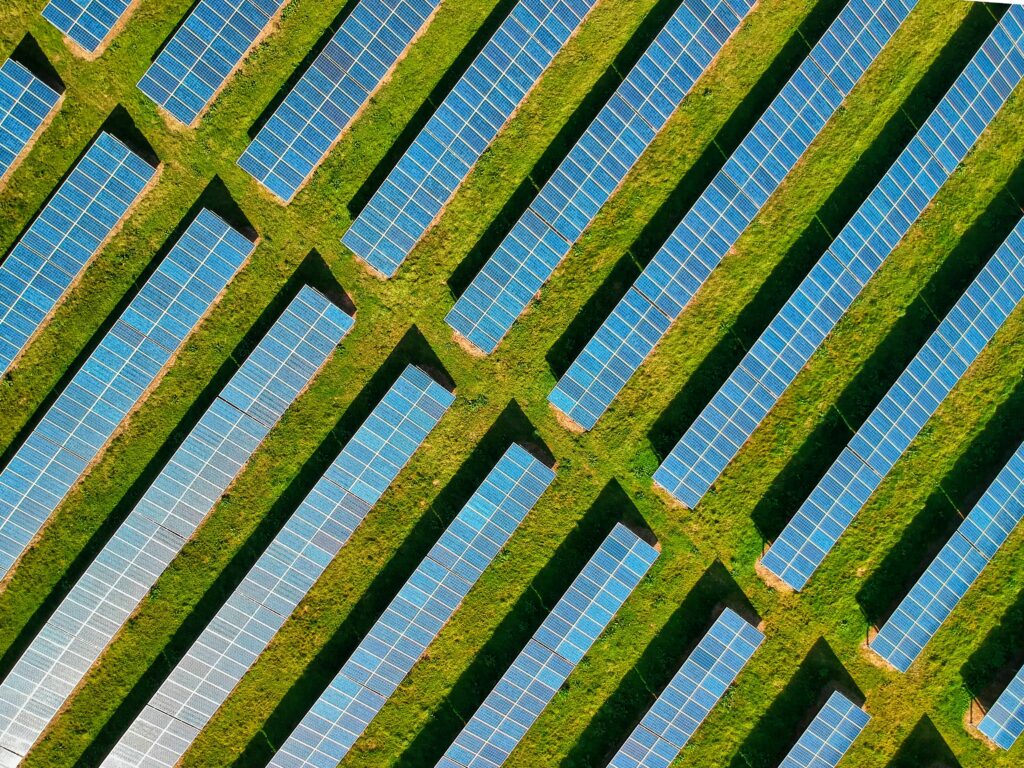

Picture those towering wind turbines gracefully spinning against the horizon, and those sprawling solar arrays shimmering under the sun, transforming photons into usable energy.

But have you ever stopped to think about how these massive green energy projects actually get off the ground?

How do they overcome the immense upfront capital costs that can reach hundreds of millions of dollars?

The answer involves a fascinating and surprisingly powerful financial tool that most people have never heard of: Tax Equity.

This isn’t just financial jargon for Wall Street insiders.

Tax equity is the invisible engine powering America’s clean energy transition, making otherwise impossible projects financially viable and attracting billions in private investment.

Without it, many of those wind turbines and solar arrays simply wouldn’t exist.

In this deep dive, you’ll discover:

- What tax equity actually is and why it emerged as the dominant financing structure for renewable energy

- How this complex financial mechanism transforms government tax incentives into real-world clean energy projects

- Why the recent Inflation Reduction Act and the surprising “One Big Beautiful Bill Act” are reshaping the entire landscape

- The ongoing controversies and limitations that have policymakers questioning whether this system is truly optimal

- What the future holds as transferable tax credits threaten to disrupt the traditional model

The Elegant Problem-Solution Dance: Understanding Tax Equity Basics

Let’s start with the fundamental challenge that created this entire industry.

Building renewable energy projects requires massive upfront capital investments.

A utility-scale solar farm can cost $200-400 million, while offshore wind projects often exceed $1 billion.

To incentivize these investments, the federal government offers substantial tax benefits—think of them as massive discount coupons that reduce your tax bill rather than giving you cash directly.

The Investment Tax Credit (ITC) for solar projects provides a credit worth 30% of the project’s cost.

The Production Tax Credit (PTC) for wind gives $26 per megawatt-hour of electricity produced over ten years.

These aren’t small amounts—they can represent 40-60% of a project’s total value.

Here’s where it gets interesting.

The renewable energy developers who build these projects often operate as limited liability companies or partnerships that don’t generate enough taxable income to fully utilize these credits.

It’s like winning a $10,000 gift certificate to a restaurant when you only eat out once a month—the value is real, but you can’t access it effectively.

This mismatch created the need for tax equity financing.

Large corporations with substantial tax liabilities—primarily major banks like JPMorgan Chase, Bank of America, and Wells Fargo—step in to provide upfront capital to projects.

In exchange, they receive ownership stakes that allow them to claim the project’s federal tax benefits.

The math works beautifully for everyone involved.

Developers get the cash they need to build projects without waiting years to realize tax benefits.

Tax equity investors earn attractive after-tax returns, typically 6-10% annually, by reducing their own tax burdens.

The projects get built, creating jobs and clean energy capacity that wouldn’t exist otherwise.

Consider a real example: a 100-megawatt solar project in Texas costing $150 million.

The developer might partner with a bank that invests $50-70 million in exchange for 99% ownership during the first five years, capturing most of the tax benefits.

After the tax credits are fully utilized, ownership typically flips back to the developer, who operates the project for its remaining 20+ year life.

The Rollercoaster History: From Boom to Bust to Boom Again

Understanding today’s tax equity market requires a journey through its surprisingly dramatic history.

Federal tax credits for renewable energy first appeared in 1978 with the Energy Tax Act, but what followed was decades of uncertainty that nearly killed the industry multiple times.

From the 1980s through the early 2000s, critical tax credits lived in constant jeopardy.

The Investment Tax Credit and Production Tax Credit faced regular expirations and last-minute renewals, creating what industry veterans call the “boom-bust cycle.”

Imagine trying to plan a multi-year, multi-million-dollar project when you don’t know if the fundamental economics will exist next year.

This uncertainty made long-term planning nearly impossible and scared away many potential investors.

The emergence of tax equity as a distinct financing structure in the mid-2000s provided some stability.

The IRS issued helpful guidance in 2007, including “safe harbor” rules that gave investors confidence their tax benefits wouldn’t be challenged.

This regulatory clarity unleashed the first major boom in large-scale renewable projects.

But then 2008 happened.

The financial crisis devastated traditional tax equity providers—the same big banks that were losing billions on mortgage securities suddenly had no appetite for risk and, more importantly, dramatically reduced tax liabilities to offset.

When you’re posting massive losses, tax credits become worthless.

The tax equity market essentially froze, threatening to kill renewable energy growth just as the industry was gaining momentum.

The Obama administration’s response was swift and creative.

The American Recovery and Reinvestment Act of 2009 introduced cash grants that developers could choose instead of tax credits.

This “Section 1603 Treasury Grant Program” provided direct payments equal to 30% of project costs, eliminating the need for complex tax equity structures.

This temporary lifeline saved countless projects and kept the industry alive during the darkest period in modern financial history.

The tax equity market gradually recovered through the 2010s as banks rebuilt their balance sheets and tax liabilities.

But the real game-changer came in 2022 with the Inflation Reduction Act.

This legislation didn’t just extend existing credits—it expanded them to cover new technologies, increased credit values, and introduced two revolutionary concepts: direct pay for tax-exempt entities and transferability for everyone else.

Then came the plot twist nobody saw coming.

In July 2025, Congress passed the “One Big Beautiful Bill Act” (OBBBA), which dramatically accelerated the phase-out timeline for solar and wind tax credits.

Projects must now begin construction by July 4, 2026, to receive full benefits—a deadline that sent shockwaves through the industry and created an unprecedented scramble to get projects started.

The Current Gold Rush: Hot Markets, New Players, and Growing Pains

Today’s tax equity market is experiencing unprecedented growth and transformation.

The annual market size has exploded from about $8 billion in 2015 to over $20 billion in 2024, with projections suggesting it could exceed $50 billion by 2030.

This isn’t just growth—it’s a full-blown gold rush driven by several converging factors.

The Inflation Reduction Act’s introduction of transferability represents the most significant structural change in renewable energy finance since the creation of tax equity itself.

Instead of requiring complex partnership structures, developers can now simply sell their tax credits directly to any entity with tax liability.

Think of it as the difference between arranging a complicated business partnership versus making a straightforward sale.

This simplicity is democratizing the market by attracting new types of investors who were previously shut out by complexity.

Insurance companies, corporations, wealthy individuals, and even smaller regional banks can now participate without needing armies of tax attorneys and structuring specialists.

A manufacturing company in Ohio with $10 million in annual tax liability can now directly purchase solar tax credits from a developer in Arizona through a simple transaction.

Traditional tax equity partnerships still dominate for the largest projects, but transferability is rapidly gaining market share, especially for smaller and mid-sized developments.

The rise of “hybrid” structures represents another fascinating innovation.

Sophisticated developers are combining traditional tax equity for depreciation benefits with transferable credits for the Investment Tax Credit or Production Tax Credit.

These “T-flip” structures allow developers to optimize their financing by using the best tool for each component of their tax benefits.

However, this boom comes with growing pains.

While capital availability has increased dramatically, the cost of that capital is rising due to persistent high interest rates and increased competition for deals.

Tax equity investors are becoming more selective, demanding better projects and more favorable terms.

The traditional bank-dominated market is also facing new pressures.

Proposed Basel III regulations could increase risk weightings for tax equity investments, potentially making them less attractive to bank investors just as demand is skyrocketing.

This regulatory uncertainty adds another layer of complexity to an already intricate market.

The Controversy Corner: Why Some Experts Question the Whole System

Despite its success in driving renewable energy deployment, tax equity financing faces significant criticism from policy experts, economists, and even some industry participants.

These concerns aren’t just academic—they point to real inefficiencies and inequities that may undermine the system’s long-term effectiveness.

The complexity problem is perhaps the most obvious issue.

Tax equity transactions require teams of specialized attorneys, tax advisors, and financial analysts, driving transaction costs that can reach $500,000 to $2 million per deal.

These costs are ultimately passed on to ratepayers and taxpayers, making clean energy more expensive than it needs to be.

For smaller projects, transaction costs can represent 3-5% of total project value, creating a significant barrier to entry.

Market concentration presents another major concern.

Historically, just five to seven large domestic banks have provided over 80% of all tax equity capital.

This oligopoly creates bottlenecks, limits competition, and gives these institutions significant pricing power.

When one major bank pulls back from the market—as happened during the financial crisis—the entire industry feels the impact.

The “value leakage” debate strikes at the heart of policy efficiency.

Developers typically receive only 85-90 cents of value for every dollar of tax credits they transfer to tax equity investors.

This 10-15% “haircut” represents billions of dollars annually that doesn’t flow to project development.

Critics argue that direct government grants or loans would be more efficient, delivering 100% of intended benefits to renewable energy projects.

Incentive misalignment creates operational challenges, particularly in wind projects.

Tax equity investors who receive Production Tax Credits benefit from maximizing electricity production regardless of market prices.

This can lead to situations where projects generate power even when wholesale prices are negative, creating grid management challenges and forcing developers to bear higher maintenance costs.

The equity and access issues are equally troubling.

Before the IRA’s direct pay provisions, tax-exempt entities like municipalities, cooperatives, and non-profits couldn’t directly access federal tax incentives.

This created a two-tiered system where well-capitalized private developers had significant advantages over community-owned projects.

Even today, many smaller developers struggle to access tax equity due to minimum transaction sizes and complexity requirements.

Environmental, Social, and Governance (ESG) questions are becoming increasingly prominent.

Can a bank legitimately claim ESG benefits from purchasing tax credits without owning or operating the underlying renewable energy project?

Some critics argue that transferable credits allow “greenwashing” by enabling companies to claim clean energy investments without meaningful operational changes.

Finally, the constant policy uncertainty creates planning challenges that ripple throughout the industry.

The OBBBA’s accelerated phase-out timeline exemplifies this problem—developers who were planning projects based on IRA timelines suddenly face a compressed deadline that may make their projects uneconomical.

This boom-bust cycle, even in modified form, continues to plague long-term industry planning.

Crystal Ball Gazing: The Future of Green Energy Finance

The next five years will likely reshape renewable energy finance more dramatically than any period since the industry’s inception.

Several powerful trends are converging to create both unprecedented opportunities and significant challenges.

The immediate priority is the OBBBA deadline scramble.

Developers across the country are racing to begin construction on solar and wind projects by July 4, 2026, to secure full tax credit values.

Missing this deadline could make projects 20-30% more expensive, creating a stark dividing line between early movers and those who fail to act quickly.

This compressed timeline is driving a massive reallocation of resources, with developers prioritizing shovel-ready projects over longer-term development pipelines.

Transferability will likely become the dominant monetization method for tax credits, potentially surpassing traditional tax equity partnerships by 2026.

The simplicity and accessibility of credit transfers are attracting a much broader investor base than traditional structures ever could.

Regional banks, insurance companies, and even individual investors through intermediary platforms are entering the market.

This democratization should increase competition and potentially reduce the cost of capital for developers.

The expansion beyond solar and wind represents another major growth driver.

The IRA significantly expanded eligible technologies, and tax equity capital is beginning to flow toward standalone battery storage, green hydrogen, geothermal, and even nuclear projects.

Each technology presents unique structuring challenges and opportunities, creating demand for specialized expertise and innovative financing approaches.

Political risk remains the wild card in any long-term projection.

While renewable energy enjoys broad bipartisan support, specific tax incentives could become bargaining chips in future budget negotiations.

The durability of IRA provisions will depend partly on their economic success and partly on shifting political priorities.

Strict enforcement of domestic content requirements and Foreign Entity of Concern restrictions could also reshape supply chains and project economics.

Financial innovation will continue accelerating as the market matures.

Expect to see more sophisticated risk management tools, standardized documentation to reduce transaction costs, and potentially even securitization of tax credit streams.

Crowdfunding platforms for smaller renewable projects may emerge, allowing retail investors to participate in clean energy finance for the first time.

Green bonds and other debt instruments will likely play increasingly important roles as the market grows beyond traditional tax equity structures.

The regulatory environment will continue evolving in response to market growth and changing priorities.

Basel III implementation could reshape bank participation in tax equity, while new IRS guidance on transferability and other IRA provisions will clarify market rules.

State-level policies, including renewable portfolio standards and storage mandates, will create additional demand drivers that interact with federal incentives in complex ways.

Powering Tomorrow: The Continuing Evolution of Clean Energy Finance

Tax equity financing, despite its complexity and controversies, has proven to be an remarkably effective tool for mobilizing private capital toward public policy goals.

Over the past two decades, it has facilitated hundreds of billions of dollars in renewable energy investment, helping transform solar and wind from niche technologies into cost-competitive mainstream energy sources.

The system’s success lies in its elegant alignment of interests: developers get the capital they need, investors earn attractive returns, and society benefits from cleaner energy infrastructure.

This symbiotic relationship has created a self-reinforcing cycle where success breeds more investment, driving down costs and accelerating deployment.

Yet the current moment represents an inflection point.

The IRA’s transferability provisions and the OBBBA’s compressed timeline are creating both unprecedented opportunities and new challenges.

The democratization of tax credit monetization promises to make clean energy finance more accessible and competitive.

But the accelerated phase-out schedule creates urgency that may favor large, well-capitalized developers over smaller community projects.

The ongoing policy debates around tax equity’s efficiency and equity implications suggest that future administrations may explore alternative approaches.

Direct government investment, loan programs, or performance-based incentives could complement or partially replace tax-based incentives.

But any transition will likely be gradual, given the massive scale of existing investments and the industry’s current momentum.

For now, tax equity remains the financial engine driving America’s clean energy transformation.

The next time you see a wind turbine spinning or solar panels gleaming in the sun, remember the complex financial choreography that made it possible.

Behind every megawatt of clean energy lies a story of innovative financing, risk management, and the power of aligning private incentives with public goals.

As we face the urgent challenge of decarbonizing our economy, understanding these financial mechanisms becomes increasingly important.

The transition to clean energy isn’t just about technology—it’s about creating financial systems that can mobilize capital at the scale and speed our climate goals demand.

Tax equity has proven that creative financial engineering can quite literally change the world, one tax credit at a time.